Horizontal Analysis Interpretation Formula { Financial Statement }

Horizontal analysis is the method of function statement analysis that represents the percentage income and percentage decrease. In the relative financial statement of the companies. In the horizontal analysis, the financial data of the companies is compared to the base of the comparative financial statement for fixing the problems within the business. I am sure you know the Basic Golden Rules of Accounting

Horizontal Analysis Interpretation and Formula

Definition

Horizontal analysis is a process used to analyzed financial statements by comparing the specific financial information for a particular accounting period with information from another period. The analysis uses such an approach to analyze historical trends.

It’s used in the review at a company financial statement over multiple periods it’s usually depicted as percentage growth over the same line items from the base year. Horizontal analysis allows financial statements used to easily spot trends and growth patterns.

Horizontal Analysis Formula

AS you know the horizontal meaning, That is Right to Left Or left to right. Also Called Parallel or smooth figures analysis. So here we check Period over Period change. Basically, we checked the growth rate in between to comparison figures. It may be

- One year to another year

- One Qtr to Another Qtr Change

- 1st Half-year to 2nd Half Year

How to Be Successful in Business, then adopt the 7 Habits of Successful People.

The formula for horizontal analysis can be deducted the amount in the base year from the amount in the comparison year.

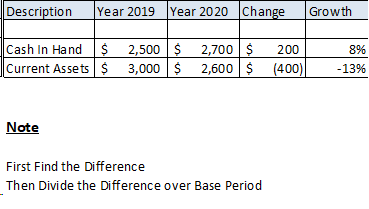

Horizontal analysis % = (Amount in Comparison – Amount in the base year)/Amount in a base year* 100)

For example:

Change in sales = (3000000 to 2800000) =200000 Percentage change= 200000/ 2800000*100=7.14%

An example is mentioned below:

Common size statements for Horizontal Analysis

In the horizontal ratio analysis common size of financial statements are used, in which the data is arranged in the horizontal form in figure and percentage that the analyst easily fixed the data and compare the change in a statement on yearly basis. In which the data on a yearly basis provided side by side. Developing your interpersonal skills and improving in Ways of Knowing you can better understand financial statement analysis.

This analysis helped companies to fix their goals and also helpful for the shareholders to highlight the weakness of the business programs and to find the way for their improvement. The horizontal analysis is conducted on both the balance sheet and profit/ loss account.

Horizontal Analysis limitations

- The basis limitation of horizontal analysis is that the aggregated information expressed in the financial statement may have changed over time and therefore will cause various to creep up when amount balances are compared across a period

- The firm can make some year-end changes to its financial statement to improve its ratios.

- It ignores the price level change due to inflation.

- It completely ignores the qualitative aspect of the business.

- Finally, Horizontal ratio analysis does not resolve any financial problem of the company.

- In Horizontal ratio analysis, some firms take into consideration all current liabilities but completely ignore the bank overdraft.

Horizontal analysis techniques

- Step 1: Use a comparative income statement and balance sheet for the period which choose to compare the minimum need to choose periods to compare but it will be able to spot trend much better it uses at least three years.

- Step2: Decide which approach is used for horizontal analysis, which has several options such as,

- Direct Comparison

- Variance

- Percentage

- Step3: Find the result, the simple way to spot the trend is to view the change from period to period but if more suitable for substitution analysis.

- Step4: Its analyst chooses various analyses either as a dollar amount or a percentage for both variance and the percentage analyst must add the column to show a change in both.

- Step 5: Horizontal analysis or financial statements like income statement balance sheet and cash flow statement at using similar techniques.

Horizontal analysis trends percentage

The percentage is calculated by first dividing the dollar change between the comparison year and the base year by the line item value in the base year and then multiply it with the value of 100.

Horizontal analysis trend %age=Dollar change= Amount of the item in comparison year

Horizontal analysis trend percentage can be found by finding the balance sheet, income statement and cash flow statement by the scheduling of current and fixed assets and statement of retained earnings.

Purpose of the horizontals analysis

Horizontal analysis is considered the most important financial statement analysis and for the annual reports.

- Horizontal analysis is used for the annual budget-making process.

- Horizontal is helpful for shareholders to check their performance and also to improve their weak areas.

- Horizontal is very useful for investors to find the percentage change in the financial position of the business.

- Horizontal vertical analyzed to a shareholder that if no change occurs into a financial statement of the business they should fix their future and also make more investment for a high gain of profits.

- Horizontal vertical is used to find have each item in the financial statement is changed, why these items are changed and also determined these changes are favourable or unfavourable for the business.

When to use horizontal analysis

- It is used to follow the investor and analysis to check what has been running a company financial performance over several years and to spot trends and growth

- The uses of that analysis enable an analysis to check the relevant charges in different line items over time and project them into the

- It is used in the review of company financial statements over multiple periods.

- It’s used to depict as percentage growth over the same line item in the base

- It allows financial statement users to easily spot trends and growth patterns.

- It shows a company growth and financial position by comparing the competitors.

- It used to manipulate to make the current period look better it a specific historical period of poor performance or chosen as a

Horizontals analysis advantages and disadvantages

Advantages

- It helps the analyst to make a proper comparison between two or more firms over a period of

- It is found to be more effective in comparison with the complete data on the basis of management decision making

- It is very helpful for the comparative analysis of data in order to measure the performance of a firm over the period of

- It is useful to measure the short term liquidity position as well as long term solvency position of the

- It is also helpful to measure the profitability position of an

- It is used to find the firm over the year with the help of some related financial trends ratios. (Operation ratio, Net profit ratio, Gross profit ratio etc).

Disadvantages

- It is not so easy to select the base year the normal year is taken as the base

- It is very difficult to apply a horizontal analysis a consistent accounting principle and policy particularly when the trends of business accounting are constantly

- It is useless at the time of price level change.

- It is not useful for comparison will present a misleading

Horizontal analysis is the aggregation of information in the financial statement that may have changed over time.

Horizontal analysis of income statement with Example

Horizontal analysis compares amount balances and ratios over a different time period. The analysis computes the percentage changes in each income statement amount at the far right.

Difference between Horizontals and Verticals analysis

- In this analysis, the analyst always compares the financial statement of the business for more than two accounting periods. This is data are arranged in side by side columns on a yearly basis.

- In VERTICAL analysis is done by an analyst only for one accounting period and in which data is arranged in the column form in figures and percentage. Vertical analysis is also called static analysis.

- In the vertical analysis, the assets, liabilities, and equity is presented in the form of a percentage. The vertical analysis shows the financial position of the business based of lined up numbers. The horizontal analysis compares the figures under the head of the financial statement and the vertical analysis compared the numbers and percentage change in line up the total of items with reference to the previous year.