Vertical Analysis interpretation Formula

In the income statement, the vertical analysis exists between the items of the income statement such as income and expenditures, Gross sales and the net profit of the business. In the balance sheet, the vertical analysis is calculated as a percentage of the total assets and liabilities. The vertical analysis of the cash flow statement is conducted among the inflow and outflow of the cash which represent the percentage of the total cash flow. Vertical analysis is helpful for the analyst to compare the companies’ data from quarterly Semi, annually and annually on the basis of a figure and the percentage.

Definitions

- Vertical analysis can be used in business to show the relation between the variables of the financial statement”.

- Vertical analysis is the most fundamental method of financial statement analysis. In the vertical analysis, all the item which existed in business lined up into a financial statement in form of a percentage on the base of the base figure”.

- The vertical analysis builds the relationship between the items of the profit/loss account, balance sheet and cash flow statement of the business numerically and percentage base.”

Vertical analysis useful for companies

It is very useful for the analyst to compare the financial position of the business year to year and also help to compare with the other companies to find the current financial status of its business.

Financial Statement Analysis

The financial statement analysis is called the trend analysis of the companies which is quarterly semi, annually and annually based to change in the financial position of the business. The financial statement analysis is very helpful for management to take a necessary decision at right time with the right information.

It consisted of the following tools for the financial statement analysis

- Horizontal Analysis

- Vertical Analysis

- Ratio Analysis

- GAP Analysis

- Swot Analysis

Before doing any analysis you should have a strong grip on Accounting Goldes Rules for judgment of Correct Journal Entries.

Financial statement for Vertical Analysis

All these companies, who cheat it financial position through vertical analysis always designed their financial statement in column form and also post the data in columns in figure and percentage. The lined-up items in the financial statement help the user to easily analyze the statement and give the report related to the financial position. These types of a financial statement included the vertical analysis in which all item are lined up in a vertical column that called column size financial statement.

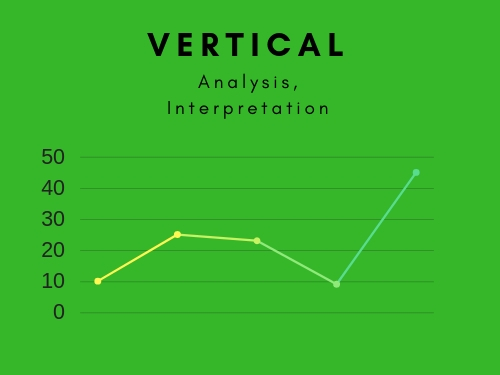

The vertical column financial statement provides a great variety of data to the user of information for their best decision making. The vertical column is available in the common size financial statement of the companies that consisted of all data in figure and percentage form. For the comparison of business to find change its financial position Vertical analysis classified into two statements.

- Profit/Loss Account Analysis

- Balance Sheet Analysis

In this analysis, the total amount of the columns is compared and multiplied by 100 to find results in percentage.

Purpose of the Vertical Analysis

The main purpose of the vertical analysis to find the interrelationship between the item of the statement and also check the volume of sales, Profit and total assets of the business. Vertical analysis is very helpful for the internal check and control system that compares the result with the specific determined benchmark rate. Vertical analysis helpful for internal staff, accountant, managers and taxation authorities for the proper decision making and also find the drawbacks of the business and to fix the issues.