Weighted Average Cost of Capital Formula Calculator WACC

The weighted average cost of capital is calculated on the basis of proportional of capital from each category of the capital of the firm. The weighted average cost is the rate at which the companies are expected to pay on average of all the securities holder and finance holder of the company assets. Weighted average cost capital is referred to the firm cost of capital. WACC raised the capital for the business from more than one source such as the debts as equity of the firm.

Full-Form of WACC

WACC full form is the Weighted Average cost of Capital.

WEIGHTED AVERAGE COST OF CAPITAL (WACC) Definition

Definition:” Weighted average cost capital is the rate that company is expected to pay on average base to all its securities, shareholders and the debts holders.’’

2 Mode of Weighted Average Cost of Capital

- Debts sources

- Equity sources

It is the basic mix of all securities which are exited into the business capital structure. Such as;

The company cost of capital = weighted average of debts and equity return

WACC is the expected relation the amount of capital is contributed to the average of all category of firm capital securities.

Sources of capital

These are various kinds of capital sources in the company which is consisted on various forms. The source of capital is included the following capital.

- Common shareholder

- Preferred shareholder

- Bonds

- Debentures

- Long term financing debts

- Capital funds

These are all included into specific rate on average base of weighted average cost capital. The rate of it is increased as proportionate to increase the rate of return on capital which also show the low level of risk. Weighted average cost capital is represented that decrease in rate of weighted average is due devaluation of assets and an increase in the risk level of the company.

However, you can use an online WACC calculator for determining the weighted average cost of capital. Usually, it is the average after-tax cost of a company’s different capital sources that include preferred shares, common shares, and debt. More specifically, WACC is an average that a firm expects to pay to finance its assets. The weighted average cost of capital calculator determines the WACC to find out the cost of every part of a company capital structure that depends on the portion of the debt, equity, and preferred stock it has. The WACC formula is used by an online WACC calculator for determining the weighted average cost of capital for a project.

It is very important for a company to know the WACC of capital for meeting the expenses of the business’s future projects. Weighted average cost capital of projects is lower than the companies should the make investment and borrow the loan for the other projects through which the companies received the high rate of return on the firm capital.

The calculation for the company (WACC)

The WACC of calculated by multiply the cost of capital sources to their weights and take the sum of the result. The calculation of weighted average cost capital consists of three steps.

- Cost of capital components

- Capital structure

- Weighted component

Cost of capital components

For calculation of weighted average cost capital of firms. All kind of firm capital is considered which firm used such as debts and equity.

- DEBTS CAPITAL The cost of the debts capital of the firm is equal to the actual rate of interest which is expected to receive on capital. The amount of tax is deducted from the adjusted debt capital of the firm.

Cost of debt capital=Rate of interest on long term debts share - Equity Capital The equity shareholders do not like to the holders of the debt to demand a high rate of return on the capital they are responsible to receive the interest on equity after the payment of the debts of the company.

Cost of equity capital=Risk-Free rate+ Market risk premium

The extra amount of risk which is attached to the equity capital is known as equity market risk premium. - Capital Structure: The portion of the market value of the debts and equity capital contribution to the firm total capital which is used for the calculation of the weighted average cost capital of the companies

- Weighted Components:In which the prescribed rate of cost of capital from each category are combined for that contribution for calculation of the weighted average cost capital of companies. The average cost of each source of capital is considered for the calculation of WACC employed in the business.

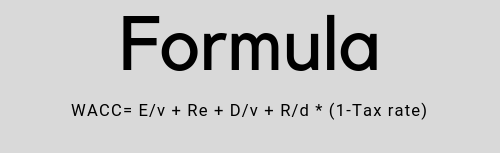

Formula for calculation of weighted average cost of capital (WACC)

WACC= E/v + Re + D/v + R/d * (1-Tax rate)

It is the proportionate average of each category of capital that used inside the business in form of common shares, preferred share, bonus and long term debts of the business.

- There are some variables are stood as;

- RE= Cost of equity

- RD=Cost of debts

- E=Market value of firm equity

- D=Market value of firm debts

- V=E+D firm value

- E/V=Percentage of financing of equity

- D/V=Percentage of financing of debts

Weighted average cost capital is the copy of the accounting equation Such as,

Assets=Liabilities + Capital

It is paid focus on the debts side of the accounting equation. The firm raised the assets by increasing the value of the debts and equity of the business. For the calculation of weighted average cost capital, the cost of equity and the cost of debts must be known by the firm. Weighted average cost capital is not only affected by the RE and RD its must be various with the capital structure. The value of RD must be lower than the value of RE.

- Higher the equity levels higher the weighted average cost capital.

- Higher the debt level lowers the weighted average cost capital.

Weighted average cost capital is involved the high level of the risk which is the firm expected to manage the risk evaluation process. It is the average cost because it is the weighted average of the business capital cost components with Accounting Rules.

For Example

Suppose a new brand business needs to raise Rs 10,00,000 in the capital it can be a buy office building and the necessary equipment to run the business.

The business issues and sells 6000 shares of stock @ Rs. 100 and shareholder expected 6%return on their investment.

Market value of firm tax rate is 35%

Business sells 400 bonds for 1000 people by bonds @5% expected return

E=6000*100=600000

D=400*100=400000

V=E + D=600000 + 400000 =10, 00,000

Re=Cost of equity which shareholder expected to received 6% return

Rd=Cost of debts is 5%

TC=35%

WACC=600000/1000000*6% + 400000/1000000*5% (1-35%)

0.049=49%

User of WACC

In business concerns the decision-makers, manager, investors, creditors, and shareholder. Joint ventures debenture holder used it.

The debtors of the companies used the WACC to know the financial position of the business such as banks and financial instructions.

All Investors, moneylender, bankers, insurance companies, WTO etc used Weighted Average Cost Capital.