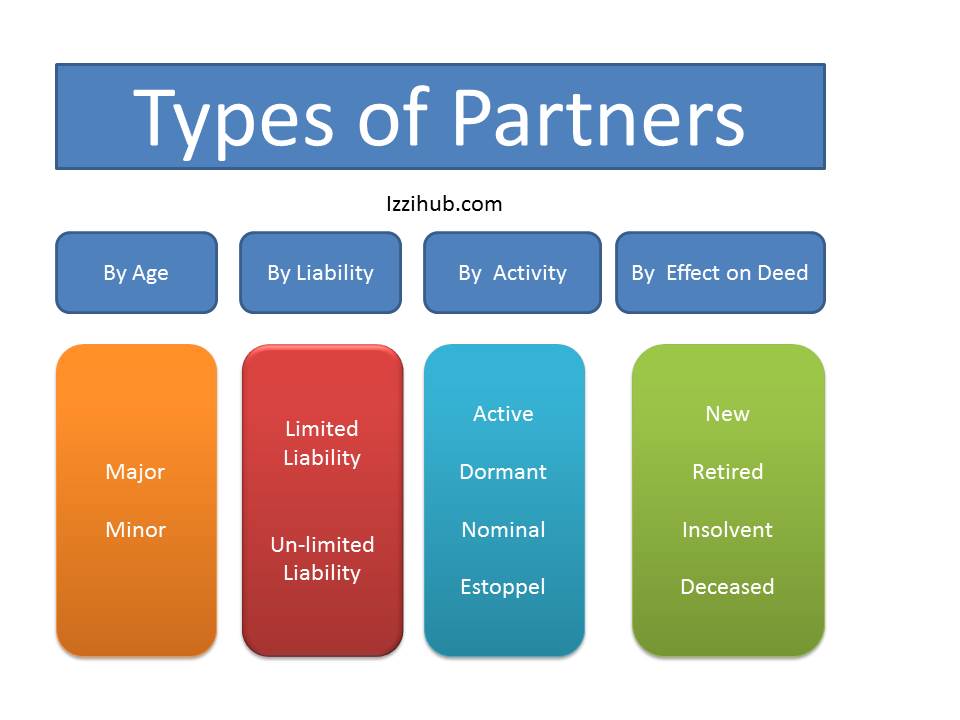

Types of Partners in Business, Nominal Dormant Estoppel Quasi 2021

Kinds, Types of Partners in Business

Partners types can be described in 4 major categories, these are as mentioned below.

- By Age

- By Liability

- By Activity

- Effecting on Partnership

Age-wise Types of Partners

- Major/Adult Partner: All those partners who are not minor. By law, all partners should be major. But in some circumstance, a minor can be a partner with the consent of other partners.

- Minor partner is those who are not Major / Adult as per country law. Usually, it is for 18 years. But vary from country to country constitution. Get More information here of Minor as a partner.

Liability wise kind of partners

- Limited Liability: In this type, the partner has limited liability towards the business loss up to the shared capital or agreed as per partnership deed.

- Unlimited liability: As per law all partners are liable to pay the debts of the business, even their personal property needs to be sold for clearing and paying the debts.

Types of Partners by Activity involvement

The active partner

is a general partner. Who participates in routine work of the business, Also called working partner. He is a person who has some special expertise over other partners, that is why have a vital role. He may be hired a worker with the consent of other partners to look after the business. He gets a salary as well as have a share of profit and loss as per the ratio defined in the agreement. Active Partner with his interpersonal skills plays a vital role in the success of the business.

Dormant/Sleeping Partner

These kinds of partners do not participate in routine business affairs. Usually, they invest and get a share of profit. However, their liability is like of general partner. That is the most common kind of partner. People usually invest in the business for earning, but not participate in business management because of involvement in other activities.

Like job holder, persons invest money and get the benefit, disabled persons may also come in these types. Liability of the partners is unlimited in this type. However, if they declare limited liability in partnership deed contents then it will be limited as per partnership agreement.

Nominal / Quasi Partner,

These are not partner by law. They lend their name to the business for its success and get charges for the use of their name. They do not invest any capital in the business and not responsible for any liability of the firm. Like Sunny Leon sell her name to a fashion boutique and get charges against her name from the boutique centre. Usually, celebrities get that type of advantages.

Estoppel Partner Or Holding Out,

These are not the actual partners of the partnership firm but by words, acts or statements mislead to others that they are partners. If a person (who is not the partner of a partnership) who by act or by words indicate or show that he is the partner of the firm but in fact, he is not, will be liable for such conduct or transaction being made on the basis of his word or act. For example, Ronaldo gives a statement that is a partner of Riddle. And on his statement, someone takes an agreement or do business transaction then, he will be liable in case of any future discrepancy.

The difference between Estoppel and Holding out Partners is that in Estoppel person himself indicate/miss leads others about his partnership member. And in holding out, his silence shows that he is a partner. Like ABC firm partners shows that XYZ is our active partner but actually he is not and XYZ also not deny or react about it then he will be called holding out partner.

Secret Partner

These are the full parter in business, Who is involved in business activities, invest the money as a capital, have a liability of the firm, get profit and loss as per their contribution or ratio agreed. But are not known to others publically. This may be due to personal issue, Repute or own will.

Partner in Profit Only

This kind of partner only get the profit and or not face the loss of the firm in routine. Means they will participate in income statements profit only not contribute to loss of business. But are liable for debts to third parties up to his personal property value.

In routine, he will not bear the loss in profit and loss of income statement but when debts come beyond the business assets then he will liable as well.

Kinds of Partners Who Effect on Partnership deed

- New Partner, Whenever a new partner needs to add, a new partnership comes into existence, which replaces the old one.

- Retired Partner, At the retirement of a partner old, will be dissolved and new will be made.

- Insolvent Partner, at the insolvency of the partner, his share is given to the relevant person as per law. Then new partnership made with new terms and condition and a share of profit and loss.

- Deceased Partner. At the death of a partner, a new partnership deed created.